Intel Looking to Revive Its Foundry Business

Posted on June 4, 2025

After years of lagging behind TSMC, Intel is taking steps to get its foundries on the cutting edge again. And it might even collaborate with TSMC to do so.

The State of Intel’s Foundries

After TSMC established itself as the premier manufacturer of semiconductors, most chip companies switched to a fabless model, simply designing their chips and relying on the Taiwanese brand to actually fabricate them.

But Intel stuck to its guns, continuing to operate its own fabs and produce its own wafers. Still, it has not managed to keep up with the scale or technological advantage of TSMC, and its foundry business has declined over the years.

Not only does it struggle to get customers, but its own chips aren’t in-house. A majority of the components of an Intel chip are fabricated in a TSMC foundry, which makes its own fabs rather redundant.

A Push For Domestic Manufacturing

While nothing fundamentally changed this state of affairs, COVID-19 exposed the pitfalls of having semiconductor manufacturing completely localized in Taiwan. The worsening geopolitical climate in the coming years further emphasized this sentiment.

The US government instituted the CHIPS to drive funding into the domestic semiconductor industry, offering incentives to any companies setting up fabs in the US. Intel, the only US chip brand not to go fabless, jumped on this opportunity.

Reclaiming the Tech Lead

Semiconductor manufacturing is limited both by the infrastructure and the technology. The additional government funding from the CHIPS Act secures the first, but what about the second?

Fortunately for Intel, they have had success in this aspect as well. Intel’s new 18A process (or 1.8nm as usually named in the industry) is managing to perform on par with TSMC’s 2nm process.

As a result, Intel can produce cutting-edge PC chips itself (for the most part), giving a big boost to its foundries. This also means that Intel’s foundries can produce chips for other fabless brands as well, offering a domestic alternative to TSMC.

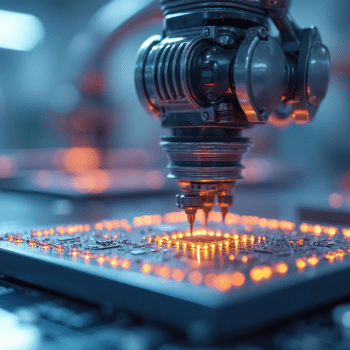

And it isn’t just speculation. Intel is already mass-producing wafers using the 18A process, and is already testing the next 14A process in its fabs as well. The company is serious about becoming a leading chip manufacturer again and has retaken the tech lead.

A TSMC Partnership?

Rumors of a TSMC partnership have been flying around for a while. After all, the companies already collaborate with each other to produce Intel chips, with some components coming from TSMC and some from Intel’s own fabs.

With TSMC already setting up its own fabs in the US, there is an opportunity for a more direct partnership. And it seems the companies are working toward it.

Intel’s CEO recently confirmed that the company is in talks with TSMC to find ways to work together, though nothing concrete has been revealed yet. They have reached a tentative agreement to set up a joint chipmaking venture, with both companies having a stake in it.

What Does it Mean for the Next Gen Chips?

Intel’s next Panther Lake and Nova Lake series are based on this same 18A process. As such, Intel is aiming to produce at least 70% of its tiles itself, with the remaining coming from TSMC.

This is expected to drive down production costs for these chips and improve the company’s margins of profitability. Which is very necessary if Intel wants to compete with AMD’s more cost-effective Ryzen.

Intel expects to continue in this vein for the next generation too, with plans for 14A already afoot. If the company can demonstrate competence with its current process, more third-party chips might also end up sourcing their production to Intel’s foundries.

Still a Long Way to Go

Things are looking up for Intel, but the company is not out of the woods yet. They have bet big on their semiconductor processes before, only to be disappointed with the results and forced to turn to TSMC again.

This led to the company replacing its leadership, and the new CEO has attempted to put the company back on the map. And for now, the efforts look promising.

Intel is still losing money on its foundry business, however, having spent big on upgrading its facilities to make these cutting-edge chips. In order to break even, it needs to demonstrate quality production at scale and attract fabless customers. The coming years will tell how successful Intel proves in this endeavor.